Remarkable, contentious leverage

secret meetings!

I know you're dying to know about some sneaky leverage in the pandemic relief package signed last week!

Apparently there's $454 billion of this package that "could then be placed into a “credit facility” and levered up 10-1," according to David Dayen at American Prospect.

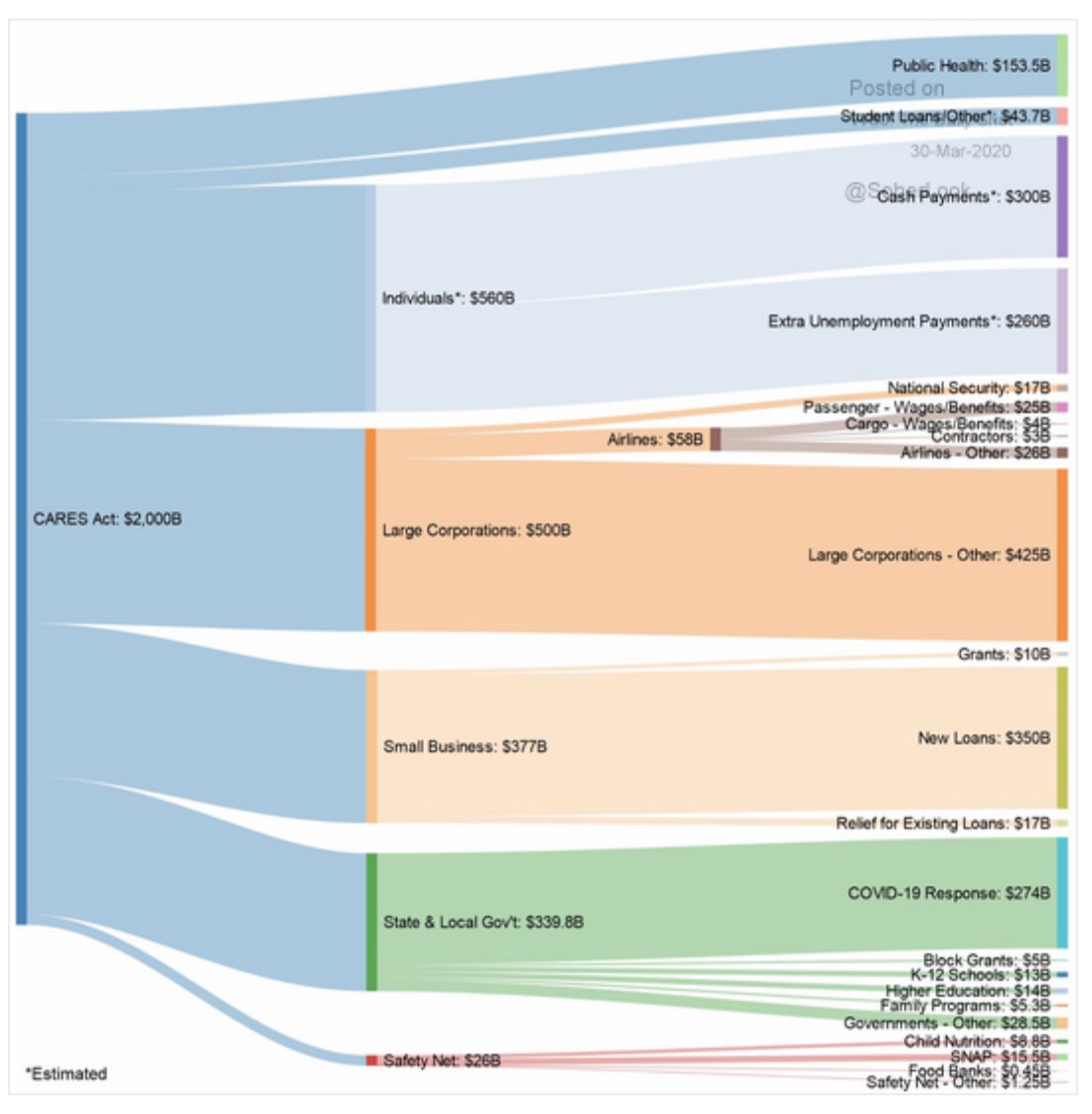

I guess this must be part of the $500 billion going to corporations? See Adam Tooze's breakdown here:

What's a credit facility and what does it mean to have the money 'levered up 10-1'? You can see it in Tooze’s tweet: the “remarkable Fed-Treasury hookup” in the contentious $425 billion to corporations.

The leverage, according to a Counterpunch article, happens because that $425 billion is going from the fiscal package to the Fed. In fact, "the taxpayers’ money takes a 10 percent stake in the various Wall Street bailout programs offered by the Fed."

And the authors there are just reading the bill directly: "Not more than the sum of $454,000,000,000…shall be available to make loans and loan guarantees to, and other investments in, programs or facilities established by the Board of Governors of the Federal Reserve System for the purpose of providing liquidity to the financial system."

So the CARES act uses a fiscal program to create a doubling force (leverage), in the amount of 10%, for the monetary policies. (Here's wikipedia on leverage.)

And here I was thinking fiscal and monetary policies were different!

The credit facilities are where that money ends up: "Special Purpose Vehicles (SPVs)" that historically let companies like Enron hide toxic debt. But we've talked about them already, the MMLF that helps municipalities, etc.

To me, this all seems like a thoroughly US version of what’s happening in Hungary. The Fed is getting the ability to hold secret meetings, use taxpayer dollars to double up their financial actions without oversight indefinitely. Maybe it’s what a state of exception looks like in the US when the enemy is a virus.